Publication Categories

Media Room

Transforming Lives Through Consumer Protection: A Call to Action for Financial Service Actors

August 28, 2024

Since EFInA’s inception in 2007, EFInA has championed financial inclusion with a strong belief that financial systems can work for all. Over the last 15 years, the proportion of formally served adults has more than doubled, from just 24% of the adult population in 2008 to 64% of adults in 2023. This increased formal inclusion has been accompanied by an unprecedented surge in digital financial services. From mobile banking to online payment platforms, the financial landscape has transformed dramatically, bringing financial services closer to people. According to EFInA’s A2F 2023 Survey, the adoption of digital financial services has grown exponentially, with millions of Nigerians daily transacting on these platforms. 45% of adult Nigerians used Digital Financial Services in 2023, up from 34% in 2020.

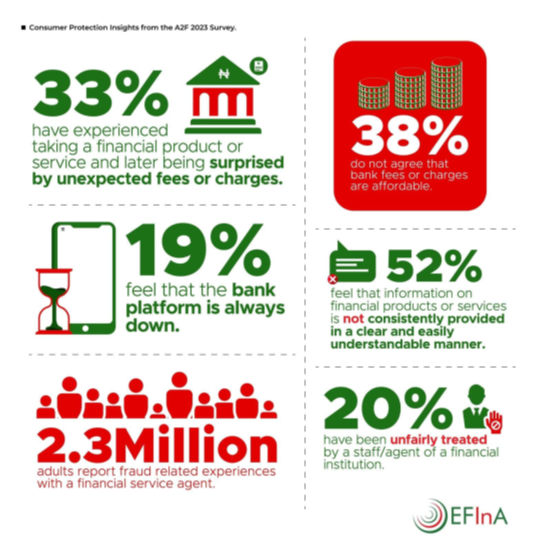

While the rapid adoption of digital financial services and innovation has increased access to formal financial services, it has brought with it financial literacy and consumer protection concerns. The A2F 2023 survey shows that a significant proportion of formally served Nigerians face challenges related to fraud incidence, poor service, high banking costs, and a lack of clarity in financial information.

On the supply side, the Nigerian financial sector has experienced substantial increases in fraud cases in recent years. This includes breaches in internal controls, cyber-attacks targeting financial institutions, and insider fraud involving employees exploiting their access to sensitive information. The rapid adoption of digital financial services, coupled with inadequate security measures, has exacerbated vulnerabilities.

Addressing these issues requires a concerted effort to strengthen cybersecurity, enhance internal controls, and implement robust fraud detection and prevention mechanisms. A detailed report by SBM Intelligence highlights that from 2019 to 2023, financial losses due to fraudulent activities surged by N14.71 billion. Despite a reduction in the number of fraud cases from 123,918 in 2021 to 95,620 in 2023, the total losses increased significantly, reaching an unprecedented N17.67 billion in 2023.

This growing trend underscores the need for stronger security measures and regulatory frameworks within Nigeria’s financial sector to protect against sophisticated fraudulent activities and to restore consumer confidence. At the macro level, this is also a priority for the regulator in line with ongoing efforts to lift Nigeria out of the FATF grey list. Additionally, effective consumer protection breeds trust, which drives formal financial inclusion and enhances the efficacy of monetary tools. These insights place a grave responsibility on financial system actors to ensure that financial services are not only accessible but also safe, reliable, affordable, transparent, fair and responsive to consumer needs. By focusing on improving the quality of financial services, we can foster trust and pave the way for a more inclusive, resilient, and sustainable financial ecosystem that benefits individuals, households, and communities alike.

On July 10, EFInA, in partnership with Decodis, convened stakeholders across the financial ecosystem to validate findings from the Digital Portfolios of the Poor survey, which seeks to understand the digital concerns of Nigerians around privacy, cybersecurity, and network failure in relation to digital financial services. The survey findings highlight a critical reality: the usage of safe and secure formal financial services is directly linked to feelings of confidence and empowerment among users. Conversely, the absence of such access leads to frustration, a sense of quitting, loss of hope, and agitation. This dichotomy underscores the profound impact that financial services can have on the emotional and psychological well-being of individuals, especially when loss (mostly irrecoverable) is suffered in a system that promises so much. For financial service providers in Nigeria, this is a clarion call to prioritize consumer protection and elevate the quality of services, including timely dispute resolutions. In a time when trust in government and institutions is waning, it is more important than ever to restore confidence through reliable and secure financial solutions.

By committing to robust consumer protection measures and enhancing the quality of financial services, financial system actors can play a pivotal role in transforming lives and rebuilding trust. The current climate of disillusionment can be overcome by demonstrating that secure, accessible, and user-friendly financial services are not just possible but are actively being pursued. This is a call to action: financial service providers and regulators have the power and responsibility to turn the tide, fostering an environment where confidence replaces despair and hope supplants frustration. Together, we can create a future where every Nigerian feels secure in their financial dealings, knowing that their interests are safeguarded and their aspirations supported.

For EFInA, in line with our role as a market facilitator, we will continue to work with stakeholders to achieve a shared vision of improving market efficiencies that can make financial services more relevant and impactful to low-income segments. Through research, thought leadership and influence, advocacy, and partnerships, we will continue to advocate for regulatory frameworks, increased financial literacy efforts, technological innovation, and collaboration that safeguards consumers and the financial system at large.

In conclusion, as we continue to embrace digital financial services in Nigeria, we must prioritize consumer protection to build trust and ensure sustainable growth. These findings remind us that our efforts have a profound impact on individuals’ lives and the broader economy.

Let us commit to creating a digital financial landscape where every Nigerian feels secure and confident in using these services. Together, we can achieve a future where financial inclusion is not just a goal but a reality for all.