Publication Categories

Media Room

Diagnostic Survey of Forcibly Displaced Persons (FDPs) in Nigeria

August 14, 2024

As of January 2024, UNHCR Nigeria reported 2.1 million Nigerian refugee returnees, 3.4 million IDPs (down from 4.2 million in September 2021), and 86,801 refugees and asylum seekers (up from 79,000 in December 2021). Additionally, approximately 6 million local residents coexist with these FDPs

FDPs are not sufficiently addressed in Nigeria’s national financial inclusion policies and initiatives and are at risk of being left behind in the pursuit of full financial inclusion and sustainable development. There is no financial inclusion data on FDPs, which makes it difficult for authorities to design policies for their inclusion, limited multi-stakeholder coordination to advance their financial inclusion, and a lack of appropriate financial products and services for their unique needs. For Nigeria to achieve full financial inclusion that truly leaves no one behind, the FDPs residing within the jurisdiction need to be addressed so that they can similarly enjoy access to and usage of quality formal financial services, which is a fundamental right for people to engage actively and participate in the economy. This is particularly important for a population segment that is excluded not just from the formal financial system but also social protection systems, unlike citizens. Similarly, special attention should be paid to ensure that FDPs are financially included and their livelihoods are rebuilt.

To address this, the Central Bank of Nigeria (CBN), supported by the Alliance for Financial Inclusion (AFI), commissioned a diagnostic study on the financial inclusion of FDPs, including asylum seekers, refugees, IDPs (Internally displaced persons), and host communities. EFInA and Finmark Trust conducted the study, profiling FDPs to recommend regulatory, policy, demand, and supply-side interventions to overcome their financial inclusion barriers. The survey, carried out between May 16 and 29, 2024, covered a sample of 1,677 respondents across 30 locations in seven states, including 1,071 IDPs, 370 refugees, and 236 local residents surrounding the FDP communities.

Livelihood Sources and Financial Health

• Main source of income for IDPs and refugees are money from farming for both men and women. Another proportion of the IDPs both male and female (14% male and 20% female) are earning income from making goods to sell and self employed in an unregistered informal business.

∙ More FDPs reported not to have any income with 21% and 26% of IDPs compared to 13% of the local residents in host communities. At least half of all the target groups earn between N15,00 and N55,000 monthly.

∙ When asked about exposure to financial literacy training, only 2.7% of IDPs, 1.4% of refugees, and 3.0% of local residents claimed to have participated in the past. For digital financial literacy programs, 5.2% of IDPs, 1.4% of refugees, and 4.2% of local residents claimed to have participated in the past.

∙ Among FDPs, 82% of IDPs, 68% of refugees, and 79% of local residents in host communities own mobile phones.

Access to Financial Services

- Mobile phone ownership was higher among IDPs (91%), and local residents (89%) compared to refugees (73%).

- Only 83% of IDPs and 81% of local residents in host communities (all of whom are Nigerian citizens) have a NIN ID.

- 7% of IDPs, 5% of refugees, and 14% of local residents had mobile money accounts.

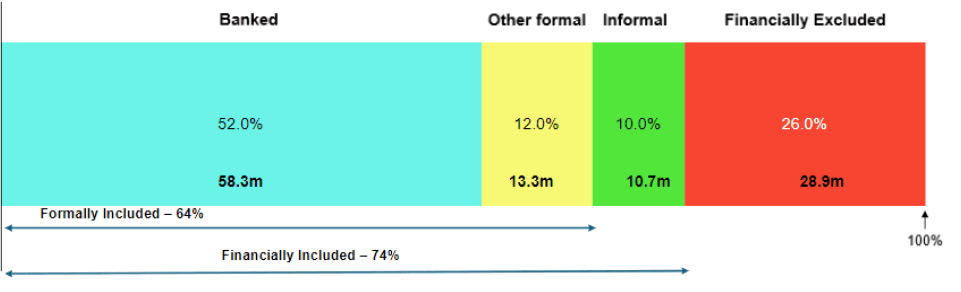

- The refugees have the highest level of formal financial inclusion, which is driven by access to commercial banks. This can be explained by previous findings that donor and government cash transfer programs are mostly done in collaboration with commercial banks as opposed to other service providers. The disparities in the level of inclusion between the three target groups are also indicative of the groups that are most likely to receive sustained social protection or durable services from the government and donors.

- The use of only informal financial services is more prevalent for IDPs and local residents who are Nigerians compared to refugees, which provides the basis for policy targeting.

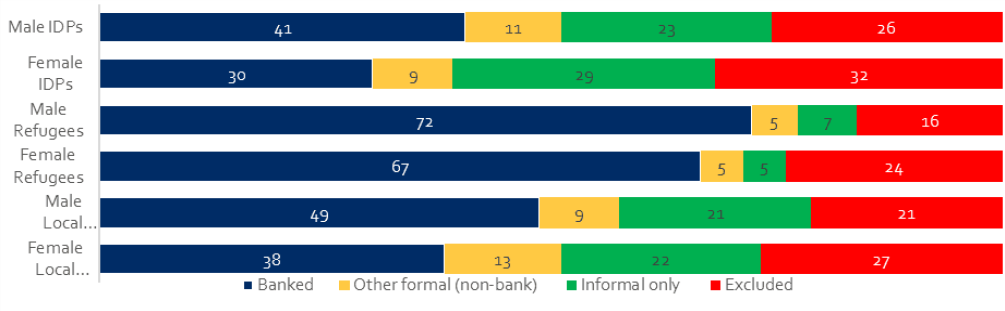

- Male refugees are the most formally included (77%), while female IDPs are the least formally included (39%). Female IDPs also tend to only use informal financial services. Female local residents in host communities are the most financially excluded. These two female groups can benefit from specific targeted policies focused on strengthening these informal groups via governance structures and equipping them for linkages to the formal system.

- IDPs claimed that savings groups are the second most important financial services to them and local residents value mobile money most after commercial banks. The use of informal financial services was found to be high amongst farmers, according to the A2F 2023 survey. Considering that farming is one of the main sources of income, this provides a policy direction on how to deepen financial inclusion for FDPs.

An assessment of the policy landscape shows that some relevant policies and regulations support the inclusion of forcibly displaced persons in Nigeria:

While the National Financial Inclusion Strategy (NFIS) III, the Roadmap for Social Protection and Humanitarian Payment Digitisation, and the National Fintech Strategy 2022 recognize and support the inclusion of forcibly displaced persons (FDPs) and host communities, there are still barriers that need to be addressed for effective implementation. Northern Nigeria, which hosts over 60% of the country’s IDPs, is a priority segment for NFIS III, making it applicable to their challenges. The Social Protection and Humanitarian Payment Digitisation Roadmap supports IDP and FDP inclusion, while the National Fintech Strategy 2022 focuses on fintech solutions for these groups, especially the most vulnerable. The National Policy on IDPs adopts a gender-sensitive approach, encouraging women IDPs to access micro-credit and financial assistance independently for economic self-reliance. Additionally, a CBN directive mandates financial service providers to accept the Machine-readable Convention Travel Document (MRCTD) and Refugee Identity Card for refugees and asylum seekers. However, the three-tiered KYC regime, requiring the linkage of tier 1 accounts to BVN or NIN, could create barriers for FDPs. Furthermore, there is no specific risk assessment of FDPs in terms of AML/CFT risks.

Findings from the supply-side stakeholders

- The findings emphasize the need for financial service providers (FSPs) to adopt a customer-centric approach, understanding the specific needs of refugees and IDPs rather than making assumptions. Education for both FSPs and refugee/IDP populations is crucial for successful financial integration, requiring tailored financial products. Hedging financial risks through grants or financial guarantees can mitigate potential losses from lending to these groups.

- Challenges in serving refugees and IDPs include concerns about their potential return to home countries and loan security. However, these populations offer new market opportunities and fulfill corporate social responsibility for FSPs.

- Government and institutional support, including from the Central Bank of Nigeria (CBN) and development programs, is essential for providing the framework and financial backing for these initiatives. Current offerings are often subsidized through international development or cash transfer programs, driving financial inclusion effectively. However, more incentives are needed to overcome barriers such as infrastructure, security, capacity on the demand side, economic exclusion, and livelihood challenges, ensuring sustainable financial services.

Recommendations for Improving Financial Inclusion and Livelihoods

The survey findings highlight several areas where targeted interventions can enhance the financial inclusion and livelihoods of FDPs in Nigeria:

- Expand literacy programs to boost awareness and usage of formal financial services and integrate fraud protection training into literacy programs to reduce vulnerability to fraud, especially on mobile platforms.

- Improve accessibility to financial access points to FDPs and host communities to increase accessibility to formal financial services.

- Expand livelihood programs to include skills training, support for social assets, and provision of productive and financial assets.

- Prioritize the integration of financial inclusion within government and development partner interventions, focusing on long-term solutions rather than temporary relief. Engage communities to ensure the success of these programs.

By addressing these key areas and implementing targeted interventions, stakeholders can work towards improving the financial inclusion and livelihoods of FDPs in Nigeria, ultimately contributing to their overall well-being and integration into host communities.